Help Me With My 401k

A 401(k) is a qualified employer sponsored savings plan to which employees may make salary deferral (or salary reduction) contributions. To participate in the plan, an employee usually has to meet certain eligibility requirements. In some cases, the employer also makes contributions to “match” the employee contributions. The general contribution from an employer is usually 3% to 6% of an employee's earnings. To qualify for the employer match, employees must contribute a specified percentage.

Once an employee is eligible to enrolled in their employer sponsored plan, they are responsible for deciding how much they should contribute, what funds to elect, whether the traditional or roth option is best, etc. These decisions can be very intimidating, and that's where we come in. We have the experience and the knowledge to help you understand your options and answer the difficult questions.

401(k) Self-Directed Brokerage Accounts

If you're a veteran 401(k) participant, you may have noticed some changes to your plan over the last few years.

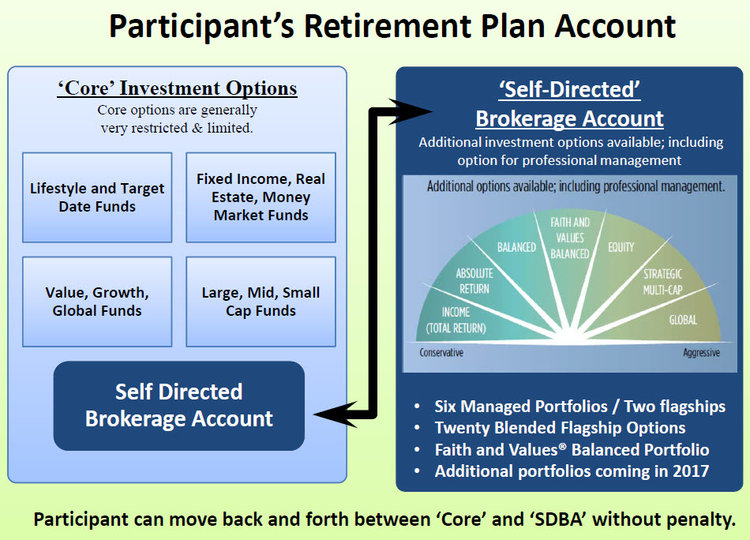

Many employers have enhanced their retirement plans to include a Self-Direction Option (SDO) that allows participants to have more choices and greater flexibility.

Another change is one that allows for plan participants to obtain investment advice for their defined contribution and deferred compensation accounts. Some 401(k) service providers have gone to the extent of offering registered investment advisory services to help plan participants manage their accounts based upon their risk tolerance and investment goals.

With the addition of these Self Directed Options or “brokerage windows”, participants and their advisors finally have the freedom to invest retirement plan assets in a much wider range of investment choices.

For investors who require more choices, more flexibility, a customized investment solution consistent for your age and number of years before retirement, as well as on-going investment advice, we encourage you to take the time to find out if your plan has been updated and how we can help you prudently coordinate this important retirement asset.

Plans that offer an SDO or “Brokerage Window” grant employees the opportunity to take full control of a portion of their current retirement account by linking it to the existing “Core” account. In doing so, participants expand the range of investment choices beyond the “Core” investments and have access to the same management style as High Net Worth Investors, Institutions, and Foundations.

Your “Core” account refers to your retirement account through your employer. The SDO or “brokerage window” offers investment options such as mutual funds, stocks, bonds and access to Fiduciary Advice through a Registered Investment Advisor.

If you're feeling overwhelmed by your choices, you're not alone. The average investor reports being confused about their 401(k), and most do not know they can get professional help. We're here for you. Our goal is to help you understand your options and make wise investment decisions.